50 Pips a day forex strategy

A well concise trading strategy is very important for profitability in forex trading. A trading strategy is a set of rules that determines the precise time to enter and exit a trade based on certain conditions in price movement. It is commonly believed that failure to plan means a plan to fail, of which forex trading is no exception.

There are a lot of profitable forex trading strategies that can be used inorder to get different trading results. This article details a unique 50 pips a day trading strategy.

The ‘50 pips a day forex strategy' is one of the easiest trading strategies that is used to spot the direction of price movement early in a trading day without the need of thorough analysis and monitoring.

As the name implies, it is a day trading strategy on the 1hr timeframe with the aim of approximately half the currency pair intraday volatility.

The strategy was designed to trade the major currency pairs particularly the EurUsd and GbpUsd but other currency pairs are not exempted. Implementing this strategy is quite different from most trading strategies because it does not require the application of indicators to analyse or determine the direction of price moves.

Without the application of any indicator, the strategy has been proven to yield good results on Forex pairs that has an average daily range of 100 pips or more.

What is an average daily range?

An average daily range of a currency pair simply refers to the mean of the daily ranges (Pip difference between the high and low) for a certain number of trading days.

How to calculate the average daily range of a currency pair?

To calculate the ADR value, you need to: Get the daily high and low of every trading day for a specified period (preferably 5 trading days). Sum up the distance between each daily high and low, and divide the sum by the number of trading days accounted for (in this case 5 trading days).

How to trade the 50 pips a day strategy

Provided the forex pair we want to trade satisfies the above conditions ( >= 100 Pips ADR) for a 50pips a day trading strategy. To put into practice this strategy, there is a simple trading plan that must be followed in order to arrive at a high probable buy or sell trade. They include the following:

- Open the daily chart and look for currency pairs that have an average daily range of 100pips or more.

- Drop down to the 1 hr timeframe and align your timezone with GMT.

- Wait for the 7 am GMT candlestick on the 1hr timeframe to open and close.

- At the close of the 7 am hourly candlestick. Immediately open two pending orders.

- A buy stop order (2 pips above the high of the candlestick) and a sell stop order (2 pips below the low of the candlestick).

- Both have a stop loss of 5 to 10 pips (above the high and below the low of the candlestick) and a profit objective of 50 pips each.

- Once these four action steps have been put in place.

Price will move towards the high or low of the 7am candlestick and activate one of the pending orders.

Let the price movement do the rest or you might want to close one of the pending orders when the other has been activated.

- Repeat this process every trading day. If the strategy brings you consistent profits, you might as well continue to use the strategy and if any day, the results are floating or price movement is consolidating, you might need to exit the trade before the end of the day.

50 Pips a day forex strategy review.

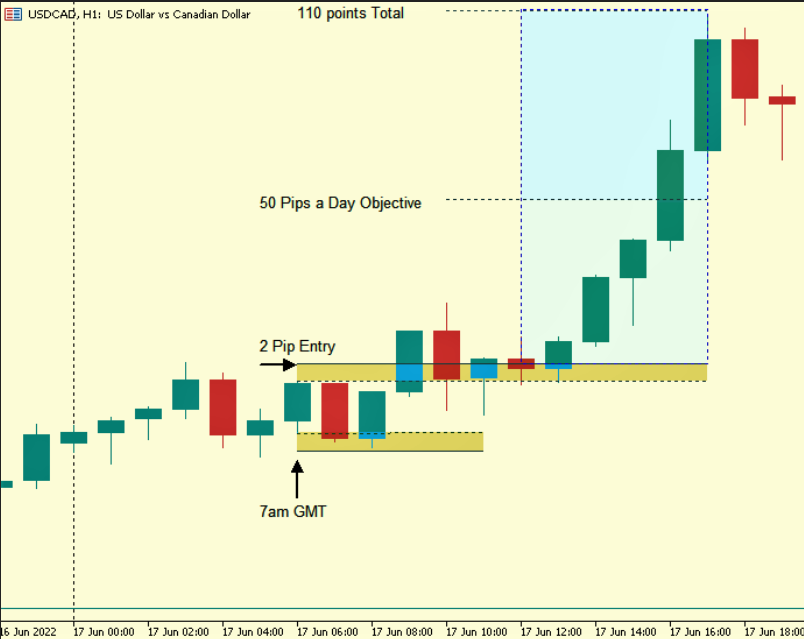

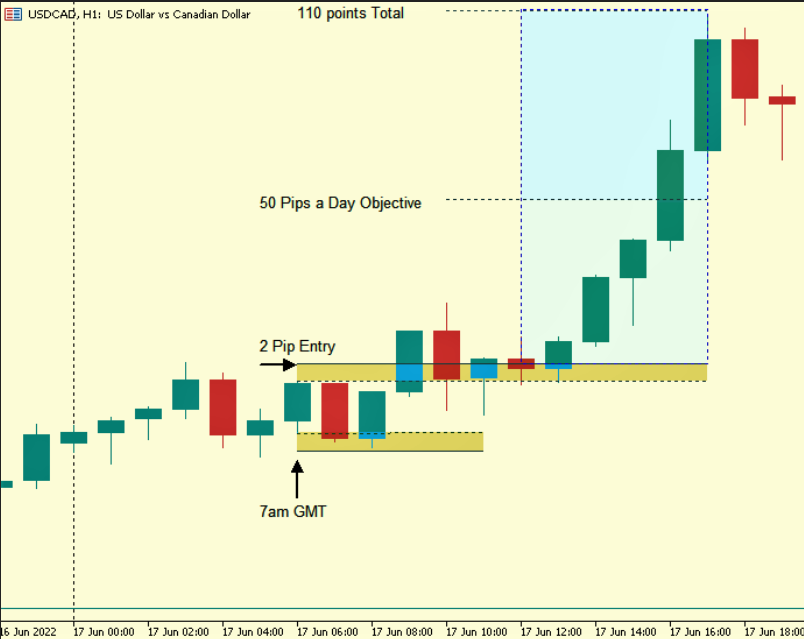

UsdCad (17 - 06 - 22)

Complimentary limit order setup to the 50 pips a day trading strategy

This setup is very similar to the popular breakout & retest trading strategy.

When price movement retraces to the high of the 7 am candlestick after breaking above it, the high of the candlestick usually acts as a level of support. Conversely, when price movement retraces to the low of the 7 am candlestick after breaking below it, the low of the candlestick usually acts as a level of resistance.

If price movement does trade above the high of the 7 am candlestick, set a buy limit order at the high of the candlestick. This order will have a stop loss just below the candlestick and 50 pips profit objective.

Also, if price movement does trade below the low of the 7 am candlestick, set a sell limit order at the low of the candlestick. This order will have a stop loss just above the candlestick and 50 pips profit objective.

Benefits of this trading strategy

- The strategy is more like a set-and-forget forex trading strategy. After putting into place all the required setups, nothing else needs to be done until the next day. This significantly reduces the time you spend staring at charts, analysing price movement, price patterns and news events with several tools and indicators.

- This strategy does not need any indicator hence it does not require constant monitoring of when and whether to close your trade nor does it require scouting for the best setup because the setup is right there at 7 am GMT every trading day of the week.

- The trading plan is great for significantly reducing risk exposures because of its tight stop loss and the limit of one setup per day hence traders cannot overtrade with the strategy.

- The number of trades or pending orders that can be opened daily depends on the number of forex pairs the day trader is looking at, that meet the criteria to trade the strategy. Therefore if a trader focuses on two forex pairs, he or she will have a maximum of two trades per day.

Limitations of the 50 Pips a day trading strategy

- This strategy presents only a single setup in the whole of a trading day therefore If you like to take more than one intraday trade setup, if you like to trade a variety of currency pairs with a variety of movements and trading patterns then this strategy is not for you.

- The profit objective of trading this strategy is limited to a maximum of 50 pips per day, a very modest day trading model although there are few forex trading strategies that promise more than 50 pips profit objective in a day but there aren't many forex trading strategies that guarantee such modest risk and returns.

- Some days, your trades might close in loss and the strategy does not provide an opportunity to take another trade

- What about the bull trap and bear trap? This happens when your trade gets triggered and is promptly stopped out as a bull trap or bear trap.

Risk management practices of the 50 pips a day forex strategy

The 50 pips a day forex strategy is a very straightforward strategy with a simple setup that is easy to follow. The strategy has a record of consistent profitability but just like every other forex trading strategy, losses can also be incurred when trading with the strategy.

With this in mind, it is important that traders follow strict risk management such as the following

- Do not risk more than you can afford to lose

- As a beginner, risk no more than 2% of your trading account balance with this forex trading strategy. When you have gotten very comfortable with the strategy over a period of time like three months and even as a professional. You should risk no more than 5% of your trading equity.

- Leveraging your trades can greatly increase your profits, as well as increase your losses. Always make sure to use minimum leverage that won't cost more than 5% of the equity of your trading account.

Most brokers allow for a trade that is currently in profit to be trailed with a trailing stop order. This is a feature that can be used to protect a trade that is already in profit so that in case there is any expected or unexpected erratic volatility or reversal of price movement, the trade does not reverse into loss.

Whenever the price of the asset moves in your favour, the trailing stop moves as well, helping you secure your profits and minimize the losses.

Frequently asked questions

Does this strategy also apply to trading the stock market?

This is a breakout trading strategy that uses the significant support and resistance of the 7 am GMT candlestick. The concept is not confined to being successful only with one market because it is based on market mechanics so the strategy can also be used to trade other financial market instruments. But it should be tested and proven to be profitable on other financial instruments before committing real money to trade.

Why use the high and low of the candlestick as a reference point?

Oftentimes, the highs and lows of a candlestick may act as both support and resistance. Price movement breaking through support or resistance can lead to strong moves in the triggered direction.

Why not have a bias and just trade one side?

Having a directional bias is a great idea. There are times when the long-term direction of the market could be bullish and a daily range might close as a bearish candlestick. In this case, you will have to miss a lot of pips on bearish price movement. The same applies if you decide to only take buy trades on a bullish directional bias.

Can I use this trading strategy as a swing trader?

This trading strategy was designed for day traders however holding on to a profitable trade for more gains with the proper risk management as discussed earlier does have its merits. To do this, You must be able to evaluate trend strength through technical analysis to confirm that a swing trade idea may be profitable.

Click on the button below to Download our "50 Pips a day forex strategy" Guide in PDF