Habits of successful forex traders

Trading in the forex market is not merely about analyzing charts and making predictions; it's a complex endeavor that requires discipline, strategy, and a set of good habits. The habits you develop as a forex trader play a pivotal role in determining your success or failure. They act as the foundation upon which your trading decisions are built.

Discipline and patience

Discipline is a crucial component of success in forex trading. It involves adhering to a set of rules and strategies consistently, regardless of market conditions or emotional impulses. Successful traders understand that discipline is what separates them from the gamblers in the market. It ensures that they make informed, rational decisions based on their trading plan rather than succumbing to emotions.

A well-defined trading plan is a vital tool for maintaining discipline. It outlines your trading goals, risk tolerance, entry and exit strategies, and position sizing. Traders who follow a structured plan are better equipped to navigate the volatile forex market, as they have a clear roadmap to guide their actions. Deviating from your plan should only occur after careful consideration and analysis, not on a whim.

Impulsive decisions can lead to substantial losses in forex trading. Successful traders exercise restraint and avoid making impulsive moves based on fear or greed. They stick to their pre-established strategies and only enter trades when the conditions align with their plan. Impatience and recklessness often lead to detrimental outcomes, which disciplined traders aim to prevent.

Patience is a trait that successful forex traders cultivate diligently. It involves waiting for the opportune moments to enter or exit trades, rather than forcing actions prematurely. Markets can be erratic, and impatience can result in hasty decisions. By exercising patience, traders increase their likelihood of making well-informed choices that align with their trading plan and risk management strategy.

Continuous learning and adaptation

Forex trading is an ever-evolving world, and the most successful traders understand the importance of continuous learning. They embrace a learning mindset, acknowledging that there is always something new to discover in the market. Whether you're a beginner or an experienced trader, staying open to new strategies, tools, and insights can lead to improved decision-making and adaptability.

Successful traders make it a habit to regularly analyze economic indicators, geopolitical events, and market sentiment. This awareness allows them to anticipate potential market shifts and make informed decisions. Being well-informed can mean the difference between seizing opportunities and suffering losses.

The forex market is dynamic and can experience sudden shifts in volatility and direction. Traders who adapt quickly to changing market conditions are better positioned to thrive. They have the ability to adjust their strategies, risk management, and trading timeframes as needed. Flexibility is a valuable trait that helps traders navigate both bullish and bearish market phases.

Keeping a trading journal is a habit that successful forex traders swear by. This journal documents every trade, including entry and exit points, reasons for the trade, and emotional state at the time. It allows traders to review their decisions, identify patterns, and learn from both successes and failures. By maintaining a trading journal, traders continuously refine their strategies and avoid repeating past mistakes.

Risk management

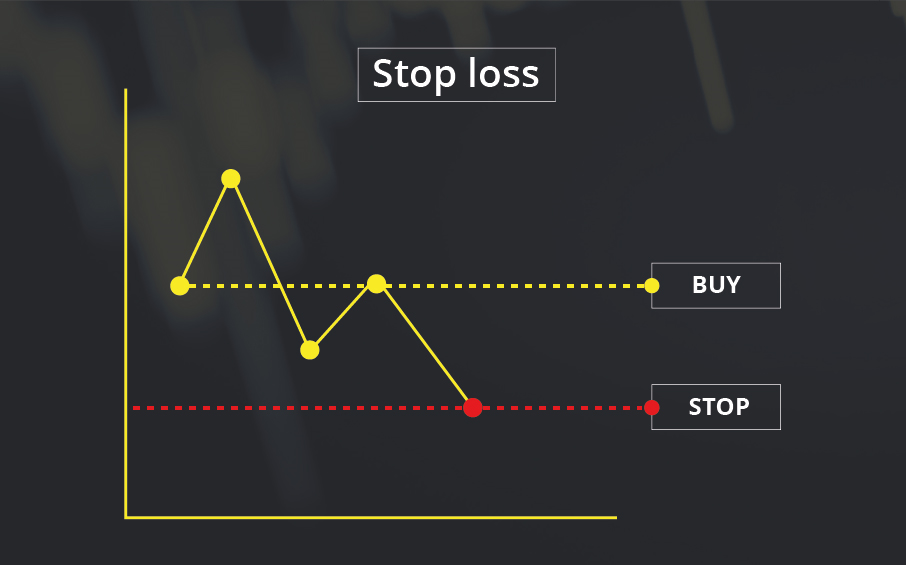

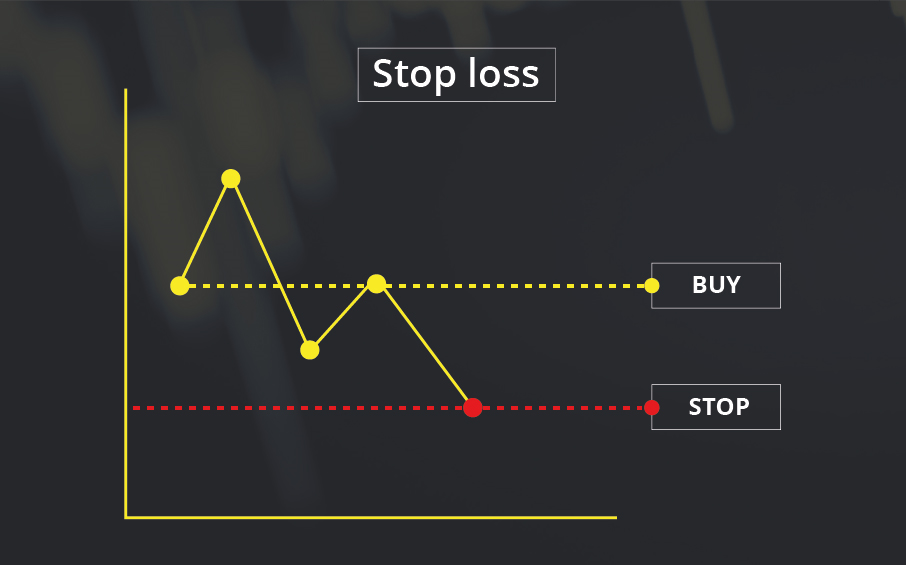

Effective risk management is a non-negotiable aspect of successful forex trading. One key habit is setting stop-loss orders for every trade. A stop-loss is a predetermined price level at which you exit a trade to limit potential losses. By adhering to this practice, traders ensure that even if a trade goes against them, the damage remains controlled. This prevents the devastating consequences of letting losses run unchecked.

Position sizing is another critical component of risk management. It involves determining the size of each trade relative to your overall capital. Seasoned traders are diligent in calculating their position sizes to align with their risk tolerance and trading strategy. This practice prevents overextending and risking a substantial portion of their capital on a single trade, allowing for better portfolio protection.

Successful forex traders understand the value of diversification. Rather than putting all their eggs in one currency pair, they spread their trades across various assets and markets. Diversification can help mitigate risk by reducing the impact of a poor-performing trade on the overall portfolio. It's a strategy that adds an extra layer of security and stability to their trading approach.

Psychological resilience

Forex trading can be emotionally taxing, especially during periods of high volatility. Successful traders recognize the importance of dealing with trading stress and anxiety. They employ strategies such as deep breathing exercises, mindfulness, or meditation to manage stress levels. By staying calm and composed, they make better decisions, even in challenging market conditions.

Emotional control is a critical habit in forex trading. Successful traders refrain from letting fear or greed dictate their actions. They have learned to detach their emotions from trading decisions, focusing on data and analysis instead. This emotional discipline prevents impulsive moves and helps maintain a rational minds

et during both winning and losing trades.

Revenge trading, driven by frustration or anger after a loss, can lead to significant financial losses. Seasoned traders make it a point to avoid this destructive habit. They understand that revenge trading is driven by emotion rather than a well-thought-out strategy. Instead, they analyze their losses objectively, learn from them, and stick to their trading plan to recover.

Successful forex traders prioritize self-care to maintain their psychological resilience. They recognize the importance of a balanced life and understand that trading should not consume their every waking moment. Regular exercise, a healthy diet, quality sleep, and spending time with loved ones all contribute to a trader's overall well-being, which, in turn, supports better decision-making and emotional stability.

Capital preservation

One of the fundamental habits of successful forex traders is making the protection of their trading capital a top priority. By diligently safeguarding their initial investment, traders ensure they have the financial resources needed to seize future trading opportunities.

Over-leverage can quickly erode a trader's capital and lead to catastrophic losses. Wise traders adhere to responsible leverage levels, never risking more than they can afford to lose. This habit prevents them from falling into the trap of excessive risk-taking and helps maintain a healthy trading account.

Successful traders adopt a long-term perspective. They do not chase short-term gains or engage in impulsive trading. Instead, they understand that consistent profitability in forex trading is achieved over time. By focusing on the bigger picture and being patient, they build a solid foundation for sustainable success.

Finally, successful traders view forex trading as a career, not a get-rich-quick scheme. They approach it with professionalism, continually refining their strategies and adapting to changing market conditions. This mindset allows them to build a sustainable trading career that can provide income and security for years to come.

Technical and fundamental analysis

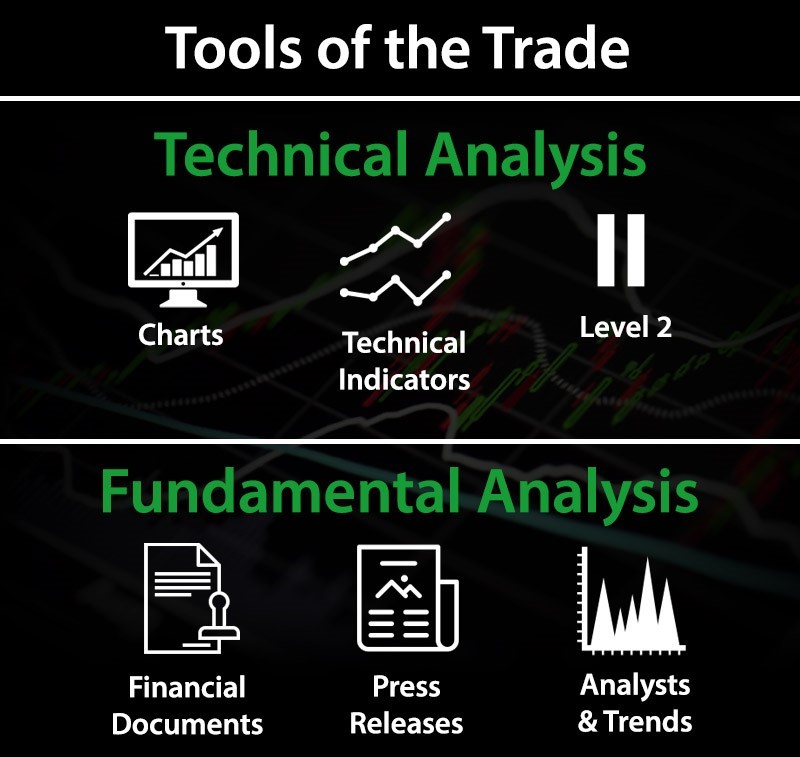

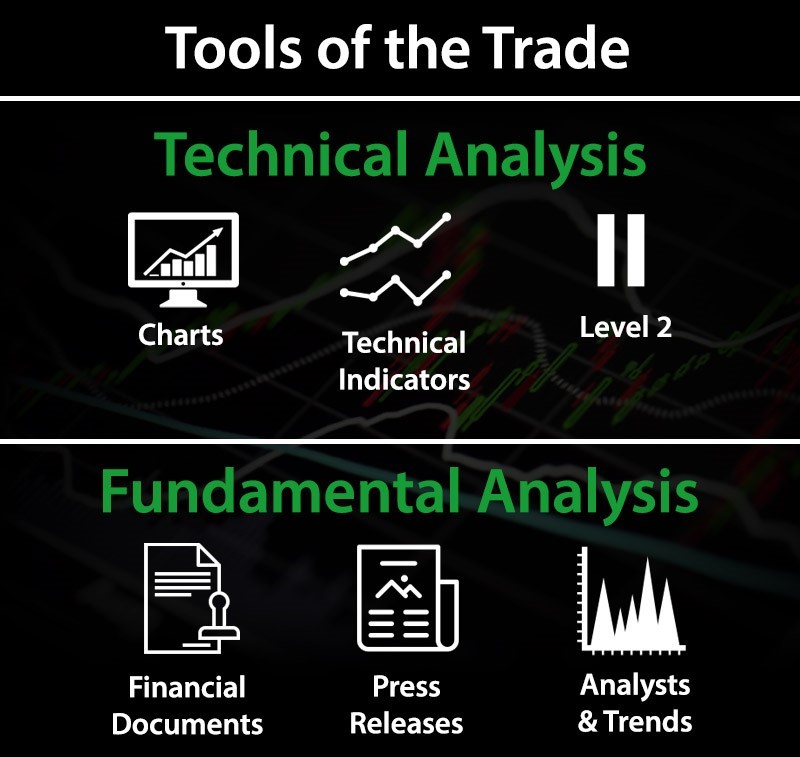

Analysis plays a pivotal role in forex trading decision-making. Successful traders understand that informed choices are based on a combination of technical and fundamental analysis. They rely on data-driven insights rather than relying solely on intuition or luck. By diligently analyzing market trends and economic indicators, traders can make well-informed and rational decisions.

An effective habit among top forex traders is the fusion of technical and fundamental analysis. While technical analysis focuses on price charts and patterns, fundamental analysis assesses economic, political, and geopolitical factors influencing currency values. By integrating both approaches, traders gain a more comprehensive understanding of the market, allowing them to identify high-probability trades and reduce the risk of making erroneous decisions.

Traders utilize various tools and indicators to aid their analysis. However, the wise ones understand that less can often be more. They select a handful of reliable tools and indicators, ensuring they are proficient in their application. Overloading with too many indicators can lead to confusion and indecision. Successful traders emphasize quality over quantity when it comes to their analytical toolkit.

Simplicity is a hallmark of effective trading strategies. Successful traders avoid overcomplicated approaches that require complex calculations or convoluted methodologies. Instead, they favor straightforward strategies that are easy to understand and implement. This minimizes the risk of analysis paralysis and allows traders to act decisively when opportunities arise.

Risk-reward ratio

A critical habit among successful forex traders is the meticulous calculation and maintenance of a favorable risk-reward ratio for every trade. The risk-reward ratio is the relationship between the potential profit and the potential loss of a trade. Seasoned traders typically aim for a ratio that ensures their potential reward outweighs their potential risk. By doing so, they ensure that even if not all their trades are winners, the gains from profitable trades outweigh the losses from unsuccessful ones, resulting in a net profit over time.

Informed trade selection is another area where the risk-reward ratio plays a pivotal role. Successful traders meticulously assess potential trades, favoring those with a favorable risk-reward profile. This means that the potential profit should be significantly greater than the potential loss, aligning with their overall trading strategy and financial goals. By consistently prioritizing trades with attractive risk-reward ratios, traders increase their chances of long-term profitability.

Conversely, wise traders are vigilant about avoiding trades with unfavorable risk-reward ratios. These are trades where the potential loss outweighs the potential gain. Such trades can quickly erode capital and hinder overall profitability. By practicing discipline and only engaging in trades with promising risk-reward profiles, traders safeguard their capital and increase their chances of success.

Conclusion

For those aspiring to thrive in the challenging world of forex trading, it's essential to recognize that success is not an overnight achievement but the result of consistent effort and the cultivation of these essential habits. Embrace discipline, nurture a learning mindset, and prioritize risk management. Practice emotional control and prioritize the preservation of your trading capital. Master the art of analysis and maintain a h