How are currency exchange rate determined

Around the world, currencies are traded for a variety of reasons and by different means. There are several major currencies that are commonly traded around the world, they include the U.S. dollar, the euro, the Japanese yen, and the British pound. The US dollar is known for its dominance over other currencies combined, accounting for over 87% of global transactions.

Currency exchange rate is the rate at which one unit of a particular currency can be traded for another currency. Commonly referred to as market exchange rates, they are set on the global financial markets where they are traded by investment banks, hedge funds and other financial institutions. Changes in market rates can occur in minutes, hourly or daily with little or large incremental shifts. The rate for a particular jurisdiction in contrast to another is typically dependent on several factors such as ongoing economic activities, changes in market interest rates, gross domestic product, and the employment rate.

In the forex market, exchange rates are quoted using a country’s currency acronym. The acronym USD, for example, is used to represent the U.S. dollar, while EUR is used to represent the euro and GBP, to represent the British pound. An exchange rate representing the pound against the dollar will be quoted as GBP/USD just as the dollar against the Japanese yen, would be quoted as USD/JPY.

Evolution of the exchange rates system

Exchange rates can be either free-floating or fixed. A fixed exchange rate is pegged to the value of another currency although they still float, but floats in tandem with the currency to which they are pegged.

Prior to 1930, international exchange rates were fixed and determined by the gold standard before a similar system called the gold-exchange standard became widely accepted. With this system, countries were able to back their currency with gold-backed currencies, notably U.S. dollars and British pounds. The International Monetary Fund (IMF) was responsible for stabilizing fixed currency exchange rates until the 1970s when the US was forced to give up any gold-controlled standard because of its dwindling amount of gold resources. As a result, the international monetary system began to be based on the dollar as a reserve currency due to the fact that the US dollar was able to achieve strong international trade through the development of a comprehensive system that managed the volatility of international trade with major countries pegged to the US dollar. On the other hand, some other countries let their currencies float freely. There are a number of economic factors that affect free-floating exchange rates, causing it to rise and fall.

Exchange rates also have what is known as a spot rate, or market value, which represents the current market rate of a currency pair. They may also have a forward value, which is based on the rise or fall of a currency against its spot price. This is largely dependent on the expected changes in interest rates. International exchange rates are currently governed by a managed floating exchange rate system having the influence of the economic activities of a country's government or central bank.

Uses of currency exchange rates

Understanding the exchange rate between currencies is crucial for investors to analyze assets that are quoted in foreign currencies. For example, understanding the dollar-to-euro exchange rate is crucial to a US investor when considering investments in a European country. Therefore, if the value of the US dollar declines, the value of foreign investments may consequently increase, even so, an increase in the value of the US dollar can have adverse effect on foreign investments.

The same holds true for international travelers who have to exchange their domestic currency for the destination's currency. The amount of money a traveler will receive for a given amount of his home currency is based on the sell rate, a rate at which a foreign currency is sold for a local currency while a buy rate is the rate at which a foreign currency is bought with a local currency.

Assume a traveler from the United States to France wants 300 USD worth of Euro on arrival in France. Considering an exchange rate presumably at 2.00, where Dollars / exchange rate = Euro. In this case, $300 will net €150.00 in return.

At the end of the trip, assume there is €50 left. If the exchange rate has dropped to 1.5, the dollar amount left will be $75.00. (€50 x 1.5 = $75.00)

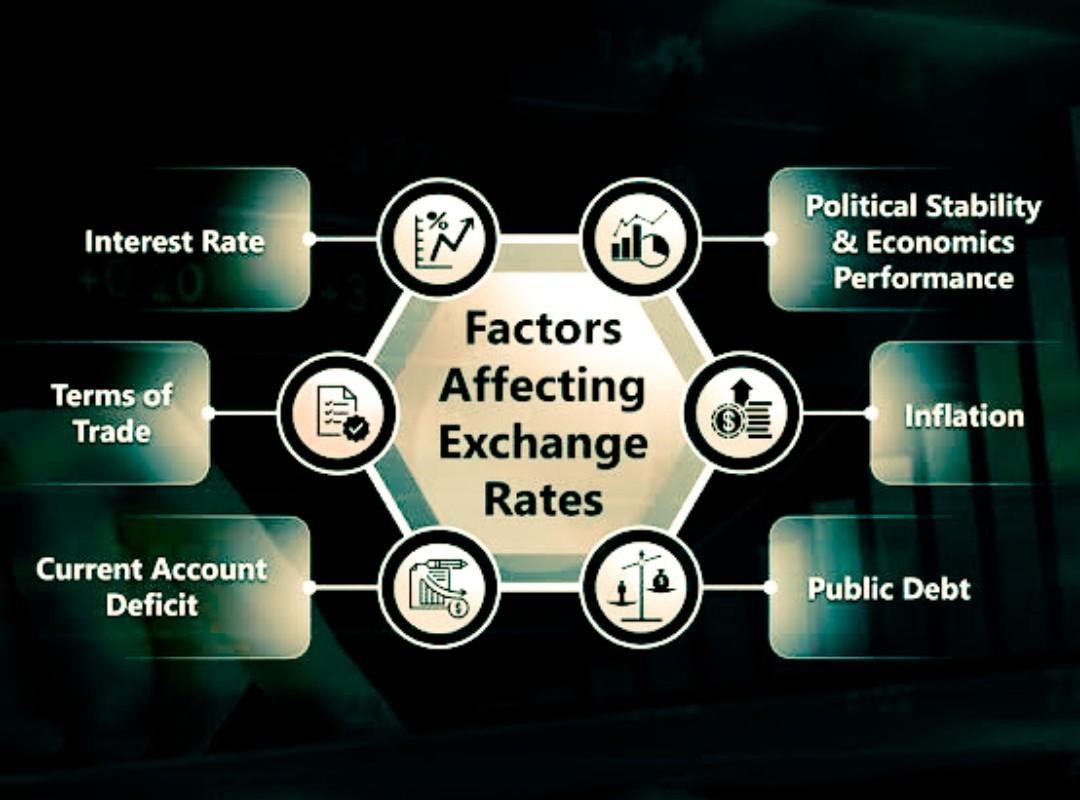

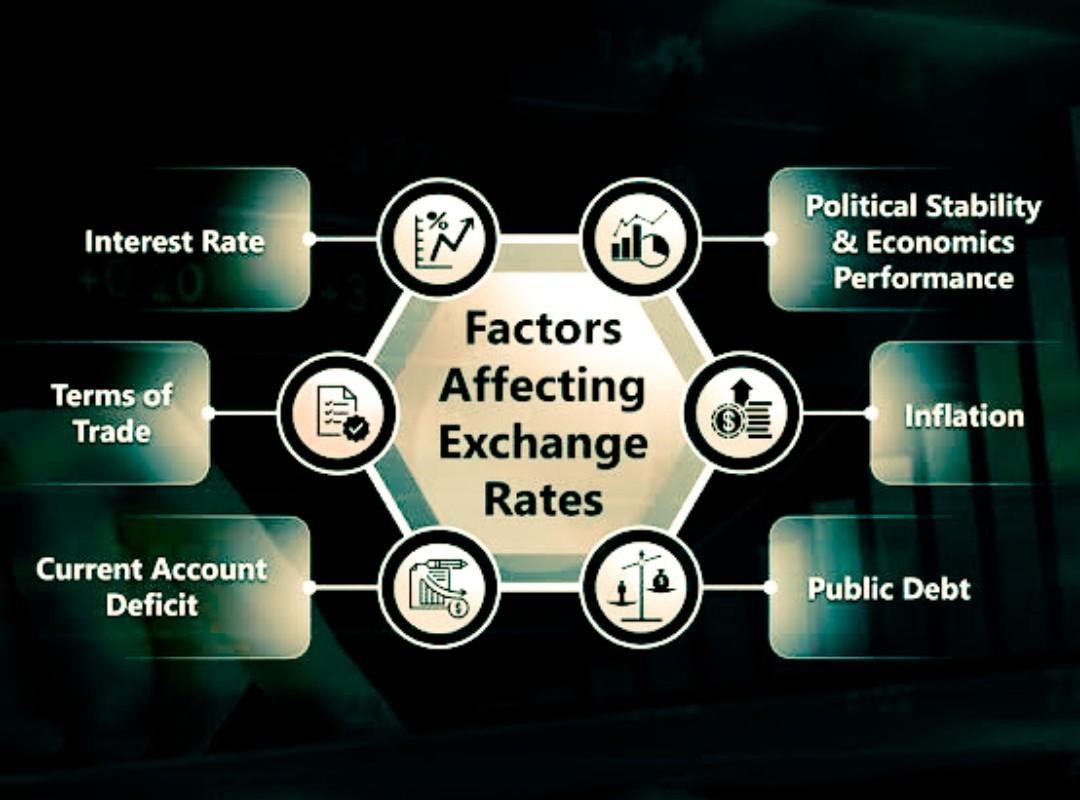

Factors that impact exchange rates

The foreign exchange market is far more complicated than the stock or bond markets. Predicting the foreign exchange rate entails predicting the performance of an entire economy. When determining exchange rates, It is important to note that exchange rates are relative and not absolute and there are many factors to consider. Below are some of the most influential factors on exchange rates.

Price expectations for the future

The most recent price on any financial market is not a reflection of current market conditions, but of previous market conditions. Therefore, the most important factor determining the exchange rate between two countries is the expectations about the future. The term “expectations about the future” sounds vague and generic. Well, the next question arises, “expectations about what?” In subsequent sections, we will explain the various expectations to look out for that influences exchange rates.

Monetary policies affecting exchange rates

The difference in monetary policies between two jurisdictions contributes to the fluctuations in their exchange rates. There are a number of factors to be considered when comparing the monetary policies of any two jurisdictions.

- Inflation: Exchange rates are basically ratios of one currency's units against another currency's units. Suppose one currency experiences inflation at a rate of 7% and another at a rate of 2.5%, any adjustments on either inflation rate will have an impact on the exchange rate. Inflation rates have a major influence on exchange rates but they do not always represent the whole situation. Market participants may also use their own estimates of inflation to arrive at a valuation for an exchange rate.

- Interest Rates: When investors invest in a certain economy, they earn a return based on the interest rate of the currency they invest in. Therefore, if an investor holds a currency with a 6% yield rather than one with a 3% yield, their investment would be more profitable because the yield on the interest will also be factored into the market's exchange rates. Therefore any adjustment made on interest rates will have a significant impact on the value of a currency. It only takes a small adjustment on interest rates by a central bank to trigger huge market reactions.

Fiscal Policies affecting exchange rates

While monetary policies are managed by the central bank of a country, fiscal policies are regulated by the government. Fiscal policies are important because they predict future changes in monetary policy.

- Deficit of public funds: The government of a country with high public debt is liable to large amounts of interest payments. The debt and interest cost may be paid from its taxes i.e. from the existing money supply. Otherwise, the country will monetize its debt by printing more money.

A huge public debt has a negative impact that will be reflected in the near future i.e it is already priced in the forex market. Note that public debts of countries can be compared relatively one to another, but absolute amounts may be less important.

- Budget Deficit: As a precursor to public debt, This factor has a significant impact on a currency's exchange rate because governments spend more money than they have and as a result, they end up with a budget deficit that must be financed by debt.

- Political Stability: The political stability of a country is also of prime importance to the value of its currency. The modern monetary system which is a system of Fiat money is known to be nothing but a promise of a government. Therefore, in times of political unrest, there is a danger that the promise of the current government may be nulled if a new government takes over. Surprisingly, a future government may decide to issue its own currency as a way of establishing its authority. For this reason, whenever a country is affected by geopolitical turmoil, there is usually a sudden drop in its currency value compared to other currencies.

- Market sentiment and speculative activities: Last but not least, the Forex market is highly speculative usually because of the opportunity to leverage trades with huge amounts of debt allowing traders to reinvest the proceeds back into the markets. This is why sentiments have a greater influence on the Forex market than they have on any other assets class because of the ease of leverage. Akin to other markets, the Forex market is also subject to wild speculation that can distort short-term and long-term investment opportunities at the same time

Conclusion

In determining currency exchange rates, the gold-standard exchange and the International Monetary Fund (IMF) added stability to the world market while they also had their own set of challenges. By pegging a currency to a finite material, the market becomes inflexible with the possibility that the country may economically isolate itself from the rest of the world. However, with a managed floating exchange rate, countries are encouraged to trade.