How to use Elliott Wave in trading

The Elliott Wave Theory is a form of technical analysis that traders use to forecast market trends by identifying repetitive patterns in collective investor behavior. Developed by Ralph Nelson Elliott in the 1930s, the theory posits that market prices move in predictable waves influenced by the underlying psychology of market participants. These waves reflect the natural ebb and flow of optimism and pessimism in the market, creating recognizable patterns over time.

In the realm of forex trading, the importance of the Elliott Wave Theory cannot be overstated. The foreign exchange market is highly volatile and influenced by a myriad of factors, making it challenging to predict currency movements. By applying Elliott Wave principles, traders can gain insights into the potential direction of currency pairs, identify strategic entry and exit points, and enhance their overall trading strategies. The ability to interpret wave patterns equips traders with a deeper understanding of market dynamics, helping them to anticipate market shifts before they occur.

Understanding Elliott Wave theory

The Elliott Wave Theory originated in the 1930s when Ralph Nelson Elliott, an American accountant and author, observed that financial markets move in repetitive cycles. By analyzing historical stock data, Elliott discovered that these cycles result from investor psychology and crowd behavior, leading to predictable patterns in market prices. His groundbreaking work provided traders with a new framework to forecast market trends based on the collective actions of market participants.

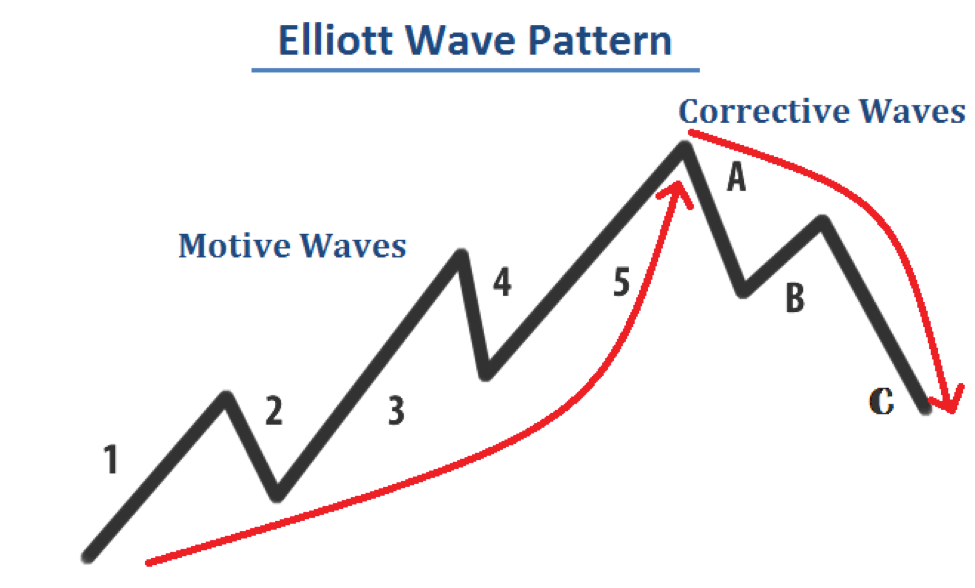

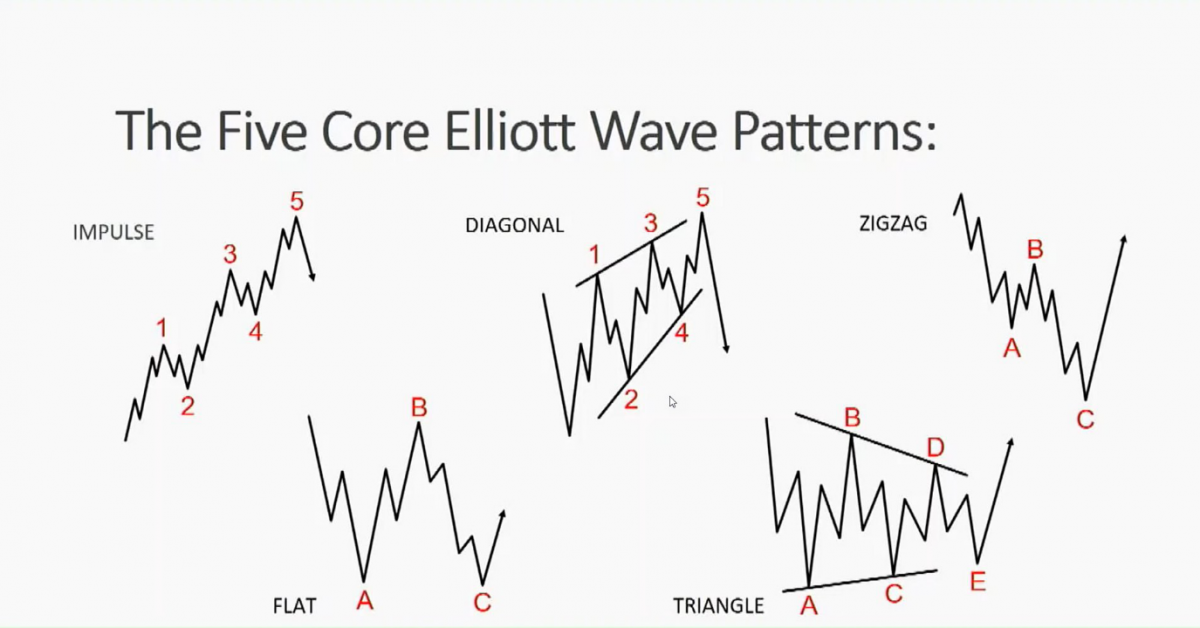

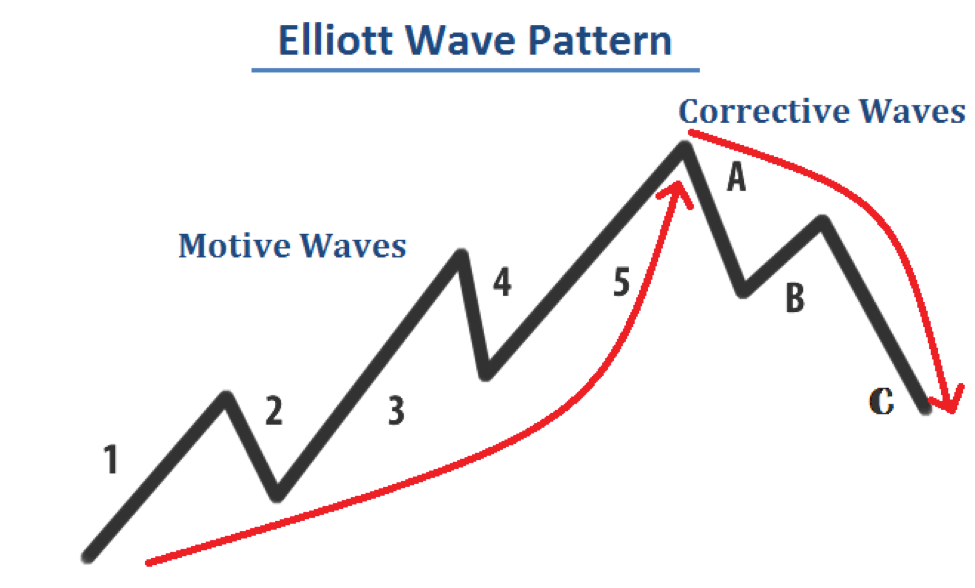

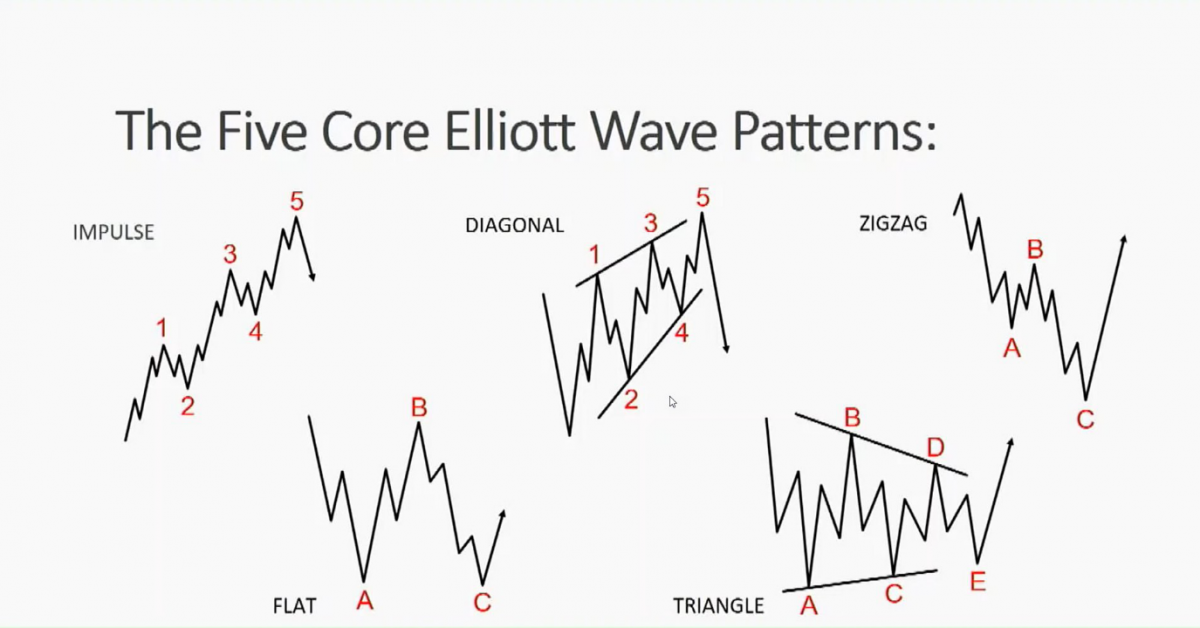

At the heart of the Elliott Wave Theory are the basic principles of wave patterns, which are divided into two main categories: impulse waves and corrective waves. Impulse waves move in the direction of the prevailing market trend and consist of five distinct sub-waves. These waves are labeled 1 through 5 and represent the driving force of the market as investor optimism fuels upward or downward movements. Impulse waves are crucial for identifying the strength and continuation of a trend.

On the other hand, corrective waves move against the main trend and are composed of three sub-waves labeled A, B, and C. These waves reflect temporary pauses or reversals in the market caused by profit-taking or shifts in sentiment. Corrective waves are essential for recognizing potential retracements and preparing for the next phase of the market movement.

How to use Elliott Wave in trading

Identifying wave patterns in forex charts is essential for traders looking to apply the Elliott Wave Theory effectively. The first step involves analyzing price charts to spot the repetitive patterns of impulse and corrective waves. Traders look for the five-wave progression in the direction of the trend (impulse waves) and the subsequent three-wave movement against the trend (corrective waves). Recognizing these patterns requires careful examination of chart highs and lows to determine the wave counts accurately.

To facilitate this analysis, various tools and techniques are employed. Charting software is indispensable, offering features that allow traders to draw and label wave patterns directly on the charts. Platforms like MetaTrader 4 or TradingView provide customizable tools for Elliott Wave analysis, enabling traders to visualize potential wave formations. Additionally, technical indicators such as Fibonacci retracement and extension levels are commonly used in conjunction with Elliott Waves. These indicators help in predicting the potential endpoints of waves by highlighting key support and resistance levels based on mathematical ratios inherent in market movements.

Applying the Elliott Wave Theory to market trends involves integrating wave pattern recognition with an understanding of market dynamics. Traders assess where the current price action fits within the larger wave cycle to forecast future movements. For instance, identifying that a currency pair is in the third impulse wave may signal a strong continuation of the trend, presenting an opportunity for entry. Conversely, recognizing a corrective wave can prompt traders to prepare for potential reversals.

How to trade Elliott Wave in forex

Trading with Elliott Waves involves a systematic approach to analyzing market movements and making informed decisions. Here is a step-by-step guide to help you apply the Elliott Wave Theory in forex trading.

Recognizing market phases

The first step is to identify the current market phase by analyzing price charts for wave patterns. Look for the five-wave impulse patterns and three-wave corrective patterns that signify the progression and retracement within the market. Understanding whether the market is in an impulse or corrective phase is crucial for anticipating future price movements.

Determining entry and exit points

Once the wave patterns are identified, use them to determine optimal entry and exit points. For instance, entering a trade at the beginning of the third impulse wave can be advantageous, as it is typically the strongest and most predictable wave. Similarly, recognizing the end of a fifth wave can signal an upcoming correction, indicating a potential exit point.

Examples of Elliott Wave patterns in forex trading

Consider a scenario where the EUR/USD pair exhibits a clear five-wave upward movement, followed by a three-wave downward correction. By identifying these patterns, traders can anticipate the continuation of the upward trend after the correction, providing opportunities for strategic trades. Such examples illustrate how recognizing Elliott Wave patterns can enhance trading decisions in the forex market.

Risk management strategies

Incorporating risk management is essential when trading with Elliott Waves. Utilize stop-loss orders to limit potential losses, especially since wave counts can be subjective and markets may not always follow predicted patterns. Combining Elliott Wave analysis with other technical indicators, such as moving averages or RSI, can also improve the accuracy of your forecasts. By managing risks effectively, you can capitalize on the insights provided by Elliott Wave Theory while safeguarding your trading capital.

Advantages and limitations of using Elliott Wave

Benefits of incorporating Elliott Wave theory

The Elliott Wave Theory offers several benefits to traders looking to enhance their market analysis. One of the primary advantages is its predictive power. By identifying repetitive wave patterns, traders can anticipate future price movements, allowing them to make strategic decisions ahead of market shifts. This foresight is particularly valuable in the fast-paced forex market, where timing is crucial.

Another significant benefit is the market insight it provides. The theory delves into the psychology of market participants, reflecting the collective emotions that drive price actions. Understanding these psychological underpinnings enables traders to grasp the underlying forces influencing currency movements, leading to more informed and confident trading decisions. Incorporating Elliott Wave analysis can thus complement other technical and fundamental strategies, offering a more holistic view of the market.

Common challenges of Elliott Wave theory

Despite its advantages, the Elliott Wave Theory presents certain challenges. A notable difficulty is the subjectivity in wave counting. Accurately identifying and labeling waves can be complex, as market patterns may not always conform neatly to the theory's guidelines. Different traders might interpret the same chart differently, leading to inconsistent analyses. To overcome this, traders should practice extensively, possibly starting with historical data to hone their skills. Utilizing software tools designed for Elliott Wave analysis can also assist in achieving more objective wave counts.

Another challenge lies in the complexity of patterns. The theory encompasses various rules and exceptions, making it intricate for beginners to grasp fully. Complex corrective patterns, in particular, can be difficult to interpret. To mitigate this, traders are encouraged to focus on mastering the basic wave structures before delving into more advanced patterns.

Tips for effectively using Elliott Wave theory

Best practices for traders

The complexity of wave patterns and the subjectivity involved in wave counting necessitate a commitment to ongoing education. Traders should regularly study market charts, back-test their analyses, and stay updated with the latest research and methodologies related to Elliott Waves. This persistent effort helps in refining skills and enhancing the accuracy of wave identification.

Another best practice is combining the Elliott Wave Theory with other technical analysis tools. Relying solely on wave patterns may not provide sufficient confirmation for trading decisions. Integrating indicators such as Moving Averages, Relative Strength Index (RSI), and Fibonacci retracement levels can offer additional insights and validation. For instance, using Fibonacci levels can help determine potential support and resistance areas that coincide with wave terminations. This multifaceted approach increases the probability of successful trades by cross-verifying signals from multiple analytical perspectives.

Resources for further learning

Expanding knowledge through reputable resources is crucial for mastering the Elliott Wave Theory. Books like "Elliott Wave Principle: Key to Market Behavior" by A.J. Frost and Robert Prechter provide comprehensive insights into wave concepts and applications. Online courses and webinars offered by financial education platforms can also be valuable, offering structured learning paths and practical examples. Websites dedicated to forex trading often feature articles, tutorials, and forums where traders share experiences and strategies related to Elliott Waves.

Conclusion

In summary, embracing the Elliott Wave Theory can significantly enhance your forex trading strategy. By interpreting market movements through the lens of wave patterns, you gain a valuable perspective on potential future price actions. This approach enables you to anticipate market trends rather than merely reacting to them, providing a strategic advantage in the fast-paced forex environment. Applying the principles learned can lead to more disciplined trading and improved risk management.