What is currency pegging

The concept of currency pegging is often referred to as fixed exchange rates. It serves the purpose of providing stability to a currency by linking its value in a predetermined ratio with that of a different and more stable currency. It also plays a significant role in financial markets by artificially reducing volatility

In order to maintain currency pegs, central banks are responsible for releasing or restricting cash flow in and out of the country to ensure that there are no unexpected spikes in demand or supply. Moreover, if the actual value of a currency does not reflect the pegged price at which it is trading, problems might arise for central banks who then have to deal with excessive buying and selling of their currency by holding large quantities of foreign currencies. In light of its status as the world's most widely held reserve currency, the US dollar (USD) is the currency to which most other currencies are pegged.

What makes up a currency peg?

- Home/domestic currency

This is an acceptable monetary unit or tender used as a means of exchange within a country. Hence it is used as the most common means of buying and selling within the country's border.

- Foreign currencies

Foreign currencies are legal tenders that are issued outside the borders of a particular country. It may be kept for monetary exchange and recordkeeping by a home country.

- Fixed exchange rate

In its simplest form, it refers to the exchange rate that has been fixed between two countries in order to facilitate cross border trades. In such a system, a central bank aligns its country's domestic currency with other currencies. This helps to maintain a good and narrow range for the exchange rate.

Typical examples of currency pegs

The US dollar

Consider the case of a country that pegs its currency to gold. Each increase or decrease in the value of gold has a relative effect on the currency of the country.

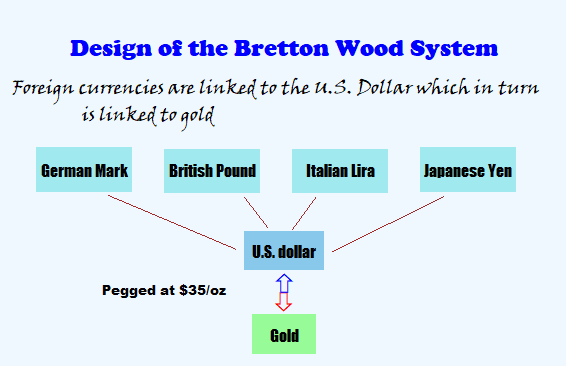

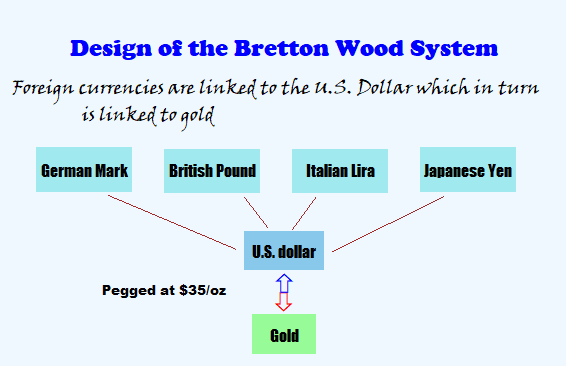

The US had huge gold reserves, which is why the US dollar was initially pegged to gold. Thus, they were able to achieve strong international trade through the development of a comprehensive system that managed the volatility of international trade with major countries pegged to its currency. It is estimated that over 66 countries have their currencies pegged to the US dollar. For example, the Bahamas, Bermuda, and Barbados pegged their currencies to the US dollar because tourism, which is their main source of income, is usually conducted in US dollars. Thus, their economies are more stable and less susceptible to financial or economic shocks. A number of oil-producing nations, such as Oman, Saudi Arabia and Qatar, also pegged their currencies to the US dollar to maintain stability. In addition, countries like Hong Kong, Singapore, and Malaysia are heavily dependent on the financial sector. Having their currencies pegged to the US dollar provides them with much-needed protection against financial and economic shocks.

China, on the other hand, exports most of its products to the United States. By pegging their currencies to the US dollar, they are able to achieve or preserve competitive pricing. In 2015, China broke the peg and separated itself from the US dollar. It then established a currency peg with a basket of 13 currencies, creating an opportunity to have competitive trade relations. Keeping their currencies at lower rates than the US dollar gave their export products a comparative advantage in the American market. Later In 2016, China restored the peg with the dollar.

Maintaining currency pegs

The US dollar fluctuates as well, so most countries would rather peg their currencies to a dollar range instead of a fixed number. Upon pegging a currency, the country's central bank monitors the value of its currency in relation to the US dollar. In the event where the currency rises above or falls below the peg, the central bank would use its monetary tools, such as buying or selling treasuries on the secondary market in order to maintain the rate.

Stablecoins

Due to the many advantages of currency pegs, this concept has been implemented in the world of cryptocurrencies as Stablecoins. The term "stablecoin" refers to a cryptocurrency whose value is anchored to the value of real-world assets, such as fiat currencies. Today, there are more than 50 projects involving stablecoins in the crypto world.

Stablecoins serve a vital purpose in an industry that is plagued by price swings of between 5 and 10% on a daily basis. Essentially, they combine the benefits of cryptocurrencies with the stability and trust of conventional fiat currencies. They also provide the convenience of easily converting crypto coins into fiat money. Tether and TrueUSD are examples of stablecoins that are pegged to the US dollar, while bitCNY is pegged to the Chinese yuan (CNY).

What happens when a currency peg is broken

It is true that pegging a currency creates an artificial exchange rate, but an exchange rate that is sustainable if approached realistically. The peg, however, is always at risk of being overwhelmed by market forces, speculation, or currency trades. In the event that this happens, the peg is deemed broken and the inability of a central bank to defend its currency from the broken peg can lead to further devaluation and severe disruption to the home economy.

The advantages and disadvantages of currency pegs

There are a variety of reasons why countries prefer to peg their currencies. Among these reasons are:

- They serve as a basis for government planning, as well as contribute to the credibility and discipline in monetary policies, particularly in the case of underdeveloped and unstable economies.

- They enhance the stability of pegged currencies

- Cross-border trade is being supported and as a result, businesses generate more real income and profits.

- By eliminating exchange risk, both the pegged currency, as well as the base currency, can benefit from enhanced trade and exchanges. The removal of economic threats and instability also makes long-term investing more rewarding to investors.

- It helps to protect the competitive level of exported goods between different countries

In what ways are currency pegs disadvantageous?

- Pegged currencies are naturally subject to foreign influence.

- Trade imbalances can make automatic exchange rate adjustment difficult. Hence, the central bank of the pegged country must monitor supply and demand to ensure the currency does not become unbalanced. To accomplish this, the government must keep adequate foreign currency reserves to counter heavy speculative attacks

- Currency pegs that are too low or too high can cause problems as well. If the exchange rate is too low, consumers' purchasing power declines, and trade tensions arise between the country with a low exchange rate and its trade partners. Meanwhile, defending the peg may become increasingly difficult due to excessive consumer spending which will create trade deficits and decrease the value of the pegged currency. This will compel the central bank to spend foreign reserves to sustain the peg. If eventually the foreign reserves get exhausted, the peg will collapse.

- Financial crises, however, are the primary threat to currency pegs. For instance, the period when the British government pegged its currency to the German DeutscheMark. Germany's central bank, the Bundesbank, increased its interest rates in a bid to curb domestic inflation. In regards to the change in the German interest rates, the British economy was adversely affected by the situation. It remains, however, that currency pegs still work as an effective tool to promote transparency, accountability, and fiscal responsibility.

Limitations that pertains to pegged currencies

Central banks do maintain a certain amount of foreign reserves that enables them to make purchases and sales of these reserves at a fixed rate of exchange without any problems. In the event that a country runs out of the foreign reserves that it has to maintain, the currency peg will no longer be valid, leading to its currency devaluation, and the exchange rate free to float.

Here are some key points

- Following the collapse of the Bretton Woods system, currency pegging gained prominence around the world. By pegging a home currency to a foreign currency, the value of the home currency will attempt to increase or decrease at a similar pace alongside its foreign counterpart.

- The central bank of a country may maintain peg in such a manner that they can buy foreign exchange at one rate and sell it at another rate.

- Currency pegging is advantageous to importers because it helps to conduct business transactions effectively since the currency exchange rate is fixed.

- The foreign currency to which most countries peg their exchange rate is the US dollar.

- There is no question that gold is the most valuable commodity on which any country can fix their exchange rates because it provides stability for their domestic economic interests.

Summary

Currency pegs also play a very important role in forex trading and learning about them can open up arbitrage opportunities for traders. Expanding one's knowledge of the markets, and understanding what influences price movements, can enhance one's ability to take advantage of not just low-risk but lucrative opportunities in forex trading.