What is floating exchange rate

During the month of July 1944, gold standard for currencies was established by the Bretton Woods Conference of 44 allied countries of world war II. The Conference also established the International Monetary Fund (IMF), the World Bank and a fixed exchange rate system of gold priced at $35 per ounce. Participating countries pegged their currencies to the US dollar, establishing the U.S. dollar as the reserve currency through which other central banks may utilize to stabilize or adjust interest rates on their currencies. Later in 1967 a large crack was exposed in the system when a run on gold and an attack on the British pound led to the devaluation of the pound by 14.3%. Eventually, the US dollar was removed from the gold standard in 1971 during President Richard Nixon's administration and then not too long after that, in 1973, the system collapsed completely. In this regard, participating currencies had to float freely.

The failure of the gold standard and the Bretton woods establishment led to what is called ‘the floating exchange rate system'. A system in which a country's currency price is determined by the foreign exchange market and the relative supply and demand of other currencies. The floating exchange rate is not constrained by trade limits or government controls, unlike a fixed exchange rate.

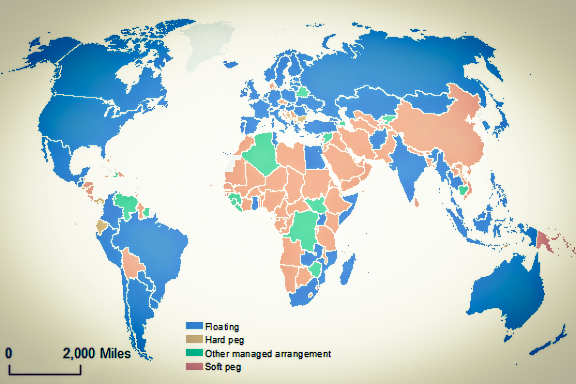

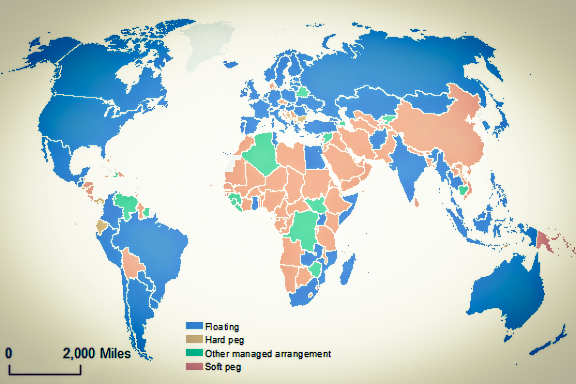

Image showing jurisdictions and their exchange rate system

Adjustments on currency exchange rates

In a floating exchange rate system, central banks buy and sell their local currencies in order to adjust the exchange rate. The goal of such adjustment is to stabilize the market or to achieve a beneficial change in the exchange rate. Coalition of central banks, such as those of the Group of Seven nations (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States), often work together to strengthen the impact of their adjustments on exchange rates, which however is often short-lived and does not always provide the desired results.

Among the most prominent examples of a failed intervention happened in 1992 when financier George Soros spearheaded a coordinated attack on the British pound. As of October 1990, the European Exchange Rate Mechanism (ERM) was close to completion. Meanwhile, the Bank of England sought to limit the volatility of the British Pound and due to its ability to facilitate the proposed euro, the pound was also included in the European Exchange Rate Mechanism. Aiming to counter what he regarded as an excessive rate of entry for the pound, Soros mounted a successful concerted attack which led to the forced devaluation of the British pound and its withdrawal from the ERM. The aftermath of the attack cost the British treasury approximately £3.3 billion while Soros earned a total of $1 billion.

Central banks can also make indirect adjustments in the currency markets by raising or lowering interest rates to affect the flow of investors' funds into the country. The history of trying to control prices within tight bands has shown that this does not always work so many nations let their currencies float freely, and use economic tools to guide their currency rate in the exchange market.

The Chinese government intervention in exchange rates is also evident through its central bank, the People's Bank of China (PBOC) - the central bank regularly intervenes in its currency rates to keep the yuan undervalued. To achieve this, the PBOC pegs the yuan to a basket of currencies in order to depreciate its value and make Chinese exports cheaper. Given that the US dollar dominates the basket of currencies, the PBOC ensures to maintain the yuan within a 2% trading band around the US dollar by buying other currencies or US Treasury bonds. It also issues the yuan in the open market to maintain that range. By doing so, it increases the supply of yuan and restricts the supply of other currencies.

The difference between floating and fixed exchange rates

When compared to fixed-rate, floating exchange rates are viewed as more efficient, fair, and free. It can be beneficial in times of economic uncertainty when markets are unstable to have fixed exchange rate systems, where currencies are pegged and price fluctuations are much smaller. The US dollar is often relied upon by developing countries and economies to anchor their currencies. By doing so, they can create a sense of stability, enhance investment, and reduce inflation. A central bank maintains its local exchange rate by buying and selling its own currency on the foreign exchange market in lieu of a pegged currency. For example, if it is determined that the value of a single unit of local currency is equivalent to 3 US Dollars, the central bank will have to ensure that it is able to supply that dollar to the market at the time required. For the central bank to maintain the rate, it must hold a high level of foreign reserves that can be used for releasing (or absorbing) extra funds into (or out of) the market to ensure an appropriate money supply and reduced market fluctuations.

Floating Rate

Unlike the fixed rate, the floating exchange rate is "self-correcting'' and is determined by the private market through speculations, supply and demand and other factors. In floating exchange rate structures, changes in long-term currency prices represent comparative economic strength and differences in interest rates across countries while changes in short-term currency prices represent disasters, speculations, and the daily supply and demand of the currency. Take for instance; if the demand for a currency is low, the value of the currency will decrease. Therefore, imported goods become more expensive, stimulating the demand for local goods and services, which in turn will cause more jobs to be created, causing the market to self-correct.

In a fixed regime, market pressures can also influence changes in the exchange rate so in reality, no currency is wholly fixed or floating. Sometimes, when a home currency reflects its true value against its pegged currency, an underground market (which is more reflective of actual supply and demand) may develop. This will prompt the country's central bank to revalue or devalue the official rate so that the rate is in line with the unofficial one, thereby halting the activity of illegal markets.

In floating regimes, central banks may be forced to intervene at market extremes by implementing measures to ensure stability and avoid inflation; however, it is rare that the central bank of a floating regime will interfere.

The impact of currency fluctuations on floating exchange rates

Economic impact

Currency fluctuations have a direct impact on the monetary policy of a country. If the currency fluctuation is constant, it can adversely affect the market for both foreign and local trade.

Impact on goods and services

If a local currency weakens, imported goods will cost more when compared to local goods and the charge will be borne directly on consumers. In contrast, to a stable currency, consumers will have the ability to purchase more goods. Oil prices, for example, are affected by large fluctuations in the international market and only stable currencies may be able to weather the impact of the price fluctuations.

Impact on business and enterprises

Currency fluctuation affects every type of business, especially businesses that are involved in cross-border or global trade. Even if the company does not sell or purchase foreign goods directly, fluctuations in exchange rates do affect their cost of goods and services.

The advantage of floating exchange rates is as follows

- Free flow of foreign exchange

In contrast to fixed exchange rate, in a floating exchange rate system, currencies can be traded freely. It is therefore unnecessary for governments and banks to implement continuous management systems.

- In terms of balance of payments (BOP), there is stability

In economics, a balance of payments is a statement that shows how much was exchanged between the entities of a country and the entities of the rest of the world over a period of time. If there is any imbalance in that statement, then the exchange rate changes automatically. A country whose imbalance is a deficit would see its currency depreciate, its exports will become cheaper causing an increase in demand and eventually bringing the BOP to equilibrium.

- No requirement for large foreign exchange reserves

Regarding floating exchange rates, central banks are not required to hold large foreign currency reserves in order to hedge the exchange rate. The reserves can therefore be used to import capital goods and promote economic growth.

- Improved market efficiency

A country's macroeconomic fundamentals can affect its floating exchange rate and portfolio flows between different countries, by improving the efficiency of the market.

- Hedge against inflation on imports

Countries with fixed exchange rates risk the importation of inflation through surpluses in the balance of payments or higher import prices. However, countries that have floating exchange rates do not experience this challenge.

Floating exchange rates suffer certain limitations

- The risk of market volatility

Floating exchange rates are subject to significant fluctuations and high volatility, so it is possible for a certain currency to depreciate against another currency in just one trading day. It is also worth noting that the floating exchange rate cannot be explained through macroeconomic fundamentals.

- Drawback on economic growth

The absence of control over floating exchange rates may lead to restricted economic growth and recovery. In the event of a negative drift in a currency's exchange rate, such an event poses serious economic consequences. Take for instance, in a rising dollar-euro exchange rate, exports from the U.S. to the eurozone will be more costly.

- Existing issues may deteriorate

When a country faces economic difficulties such as unemployment or high inflation, floating exchange rates may exacerbate these issues. For example, devaluation of a country's currency at a time when inflation is already high may cause inflation to increase and may worsen the country’s current account due to an increase in the cost of goods.

- High Volatility

The system makes floating currencies to be highly volatile; as a result, they affect the country’s trade policies directly or indirectly. If the volatility is favorable, the floating exchange rate can benefit both the country and investors but due to its volatile nature, investors might not want to take higher risks.