What is spread betting in forex

The world of financial markets has witnessed a notable surge in the adoption of both spread betting and CFD trading. This surge can be attributed to the accessibility and flexibility these methods offer to traders of varying experience levels. As individuals increasingly seek diversified investment avenues, understanding the nuances of these trading mechanisms becomes very important.

Exploring spread betting in forex

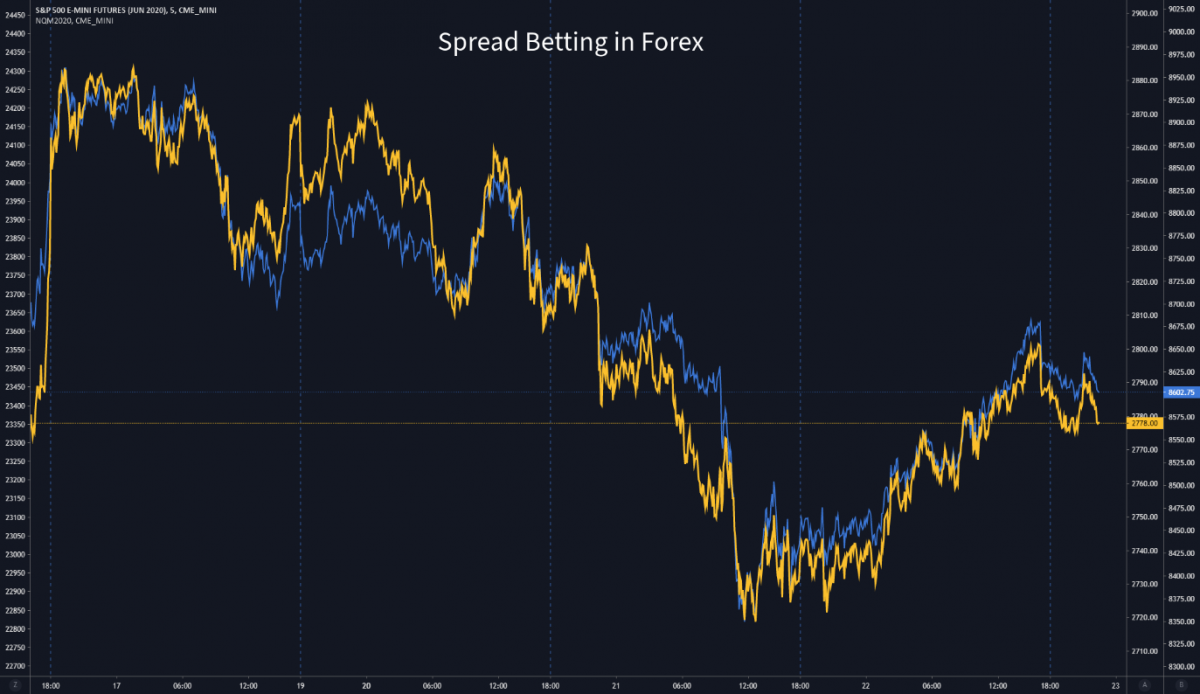

In the world of forex trading, spread betting is a unique financial derivative that allows traders to speculate on the price movements of currency pairs without directly owning the underlying assets. Unlike traditional forex trading, where traders buy and sell actual currency units, spread betting involves betting on whether the price of a currency pair will rise (go long) or fall (go short). The term "spread" in spread betting refers to the difference between the bid (selling) price and the ask (buying) price of the currency pair. This difference, expressed in pips, represents the cost of the trade and the profit or loss potential.

Spread betting offers several advantages for forex traders. Firstly, it provides tax benefits in many countries, as profits from spread betting are often exempt from capital gains tax. This tax advantage can significantly enhance a trader's overall returns. Secondly, spread betting is known for its flexibility. Traders can choose their position size, and there is no need to worry about lot sizes or contract sizes as in traditional forex trading. Additionally, it allows for both long and short positions, enabling traders to profit from falling markets as well.

While spread betting offers unique advantages, it also carries inherent risks. The primary risk is the potential for significant losses, as leverage is commonly used in spread betting, amplifying both profits and losses. It is vital for traders to have a well-defined risk management strategy, including setting stop-loss orders and maintaining adequate capital. Additionally, traders should be aware of the spreads themselves, as they can vary between brokers and impact overall trading costs.

Understanding CFD trading in forex

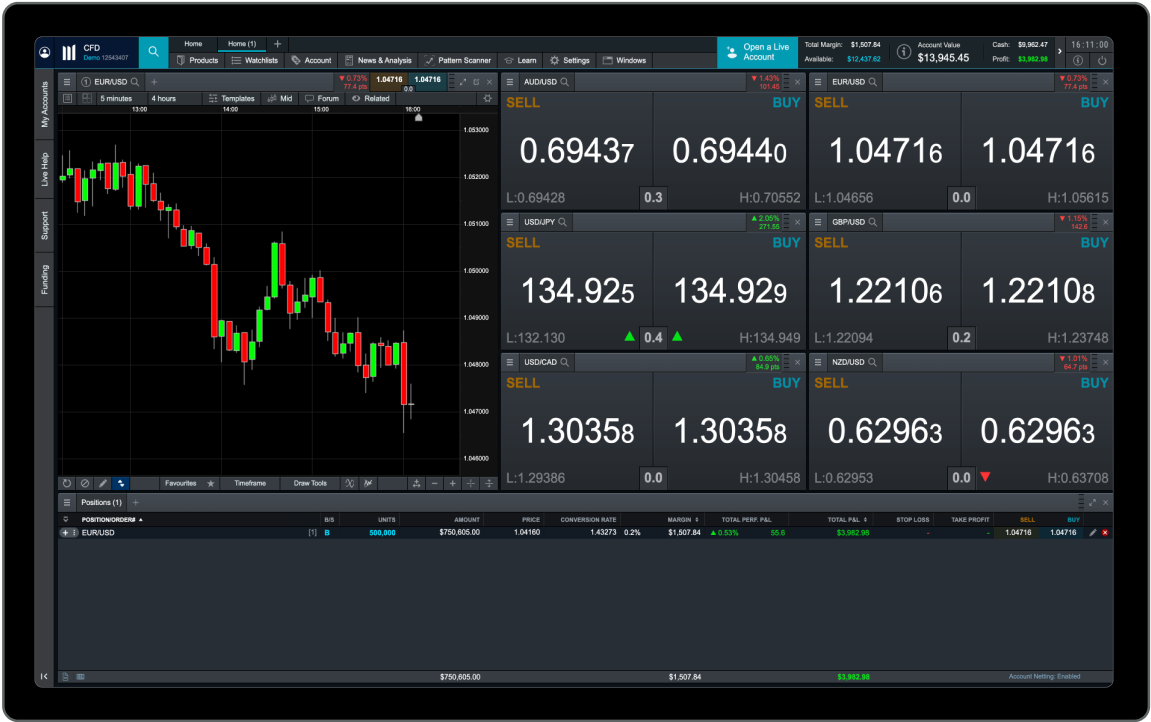

Contract for Difference (CFD) trading is a financial instrument that allows traders to speculate on the price movements of various assets, including forex currency pairs, without owning the underlying assets themselves. In the context of the forex market, CFDs represent agreements between traders and brokers to exchange the difference in the value of a currency pair between the opening and closing of a trade. This means that traders can profit from both rising (going long) and falling (going short) markets. Unlike spread betting, CFDs are based on contract sizes and do not involve the concept of spreads.

CFD trading offers several advantages when applied to the forex market. Firstly, it provides traders with access to a wide range of currency pairs and other financial assets, allowing for diversified trading strategies. Moreover, CFDs are typically more transparent regarding pricing, as there is no spread involved; traders buy and sell at the market price. This can lead to lower trading costs compared to spread betting in some cases. Additionally, CFD trading allows for the use of leverage, amplifying potential profits.

Despite its advantages, CFD trading carries certain risks. The use of leverage can lead to significant losses, especially if not managed prudently. Risk mitigation in CFD trading involves setting strict stop-loss orders and being cautious with leverage levels. Traders should also be aware of overnight financing charges, which can accumulate if positions are held overnight. As with any financial instrument, a well-thought-out risk management strategy is essential for traders engaged in CFD trading in the forex market.

Key differences between spread betting and CFD trading

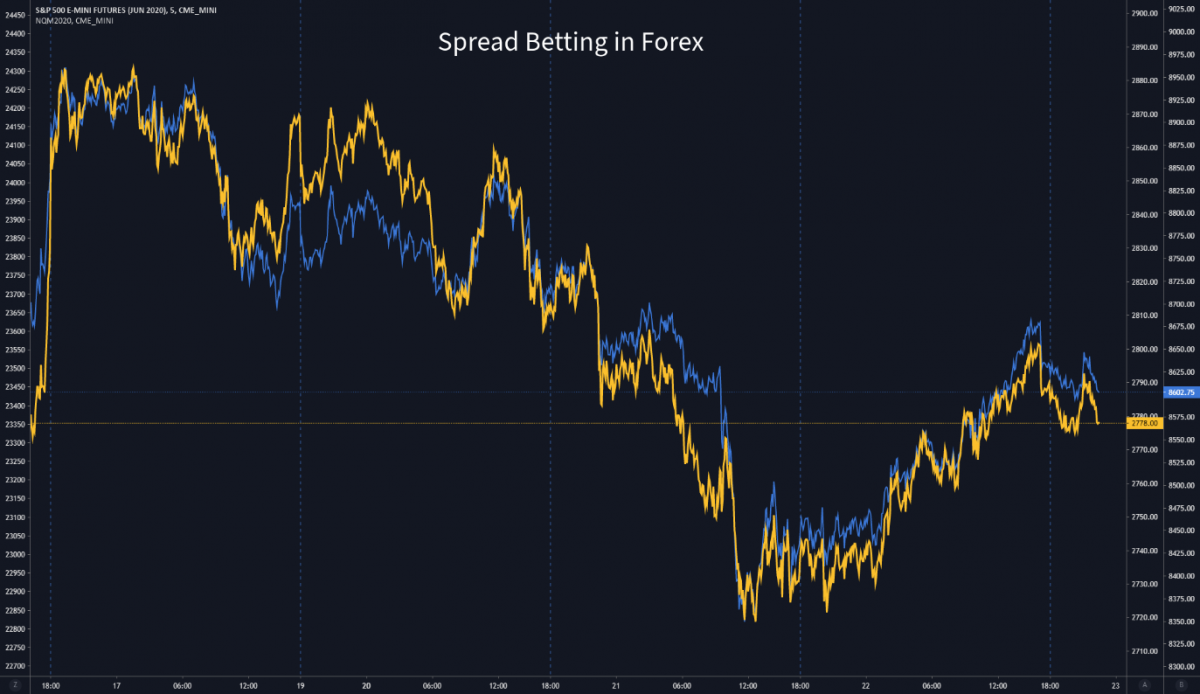

In spread betting, leverage is often inherent, allowing traders to control a more substantial position with a relatively small capital outlay. Margin requirements are typically lower, making it possible for traders to access the forex market with less upfront investment. However, this high leverage comes with heightened risk, as it magnifies both profits and losses. On the other hand, CFD trading also offers leverage but with more variability. Leverage levels are set by brokers and can vary significantly between different providers. Traders must be mindful of the leverage offered and adhere to risk management practices to avoid excessive exposure.

One significant difference between spread betting and CFD trading is the tax treatment of gains and losses. In many jurisdictions, spread betting enjoys a tax advantage, as profits are often exempt from capital gains tax, stamp duty, or similar levies. This can lead to more favorable after-tax returns for spread betters. CFD trading, however, does not typically offer these tax benefits. Gains from CFD trading may be subject to capital gains tax, depending on local regulations, potentially reducing overall returns.

Spread betting does not involve ownership of the underlying assets; traders are merely speculating on price movements. In contrast, CFD trading allows traders to have a contractual claim on the underlying assets, which means they may have certain shareholder rights, such as voting privileges in the case of stocks. This key difference can impact the trader's relationship with the asset and their ability to participate in corporate actions.

When comparing the costs associated with spread betting and CFD trading, it's essential to consider several factors. In spread betting, the primary cost is the spread itself – the difference between the bid and ask prices. There are no commissions, but overnight financing charges may apply if positions are held overnight. In CFD trading, costs can include spreads, commissions, and overnight financing charges, which can vary between brokers. Traders should carefully assess these cost structures and factor them into their trading strategies to ensure cost-effective trading.

Which approach is right for you?

Before diving into either spread betting or CFD trading in the forex market, it is crucial to begin by assessing your unique trading goals and risk tolerance. Traders come from diverse backgrounds and have varied objectives, ranging from speculative short-term gains to long-term investment strategies. Ask yourself questions such as:

What are my financial objectives for trading in the forex market?

Am I seeking short-term profits or long-term investment opportunities?

How comfortable am I with risk, and what is my risk tolerance?

Understanding your goals and risk tolerance will provide clarity on the trading approach that best suits your needs. It's essential to align your chosen method with your objectives to achieve a successful trading experience.

Once you have a clear understanding of your trading goals, you can make an informed decision between spread betting and CFD trading. Here are some considerations to guide your choice:

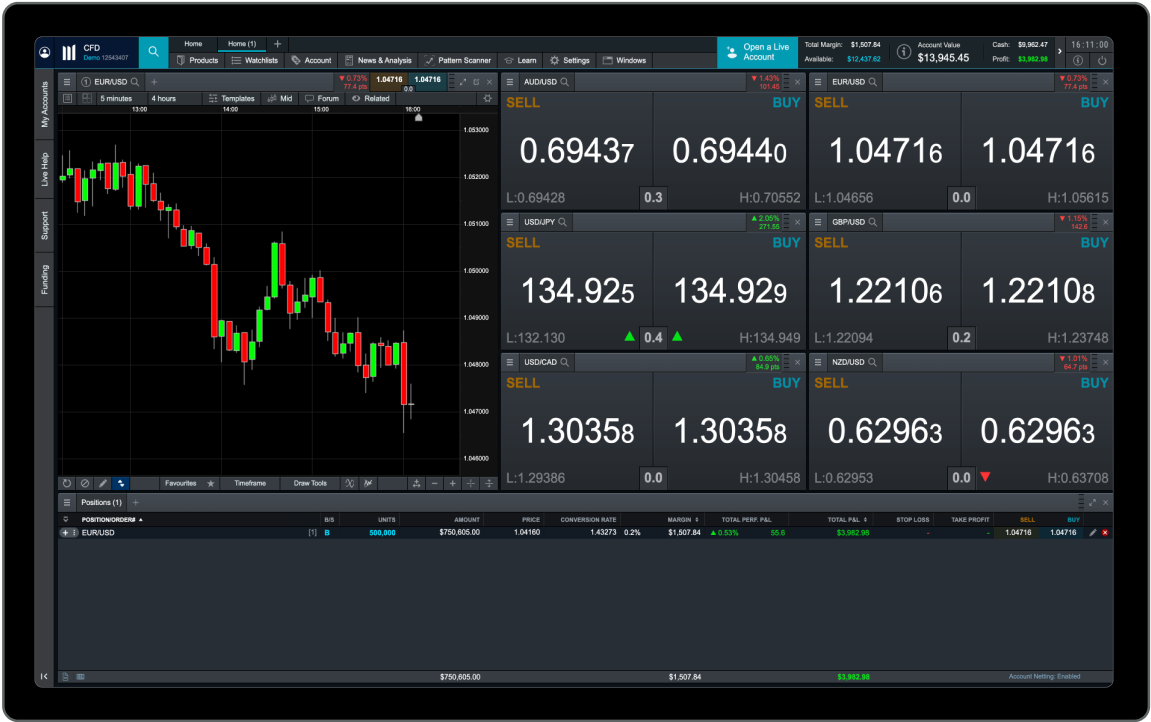

Risk appetite: If you have a higher risk appetite and are comfortable with leveraged positions, both spread betting and CFD trading may be suitable. However, be cautious and ensure you have a robust risk management strategy in place.

Tax implications: Assess the tax laws in your jurisdiction to understand the potential tax advantages or disadvantages of each method.

Ownership preference: Consider whether you prefer the idea of owning the underlying assets (CFD trading) or are content with speculating on price movements without asset ownership (spread betting).

Cost structure: Analyze the cost structures, including spreads, commissions, and overnight financing charges, and how they align with your trading budget.

Risk management strategies for forex traders

Forex trading, whether through spread betting or CFDs, carries inherent risks that demand prudent risk management. Failing to manage risks can expose traders to significant losses that may outweigh their gains. It is essential to acknowledge that forex markets are volatile, and unpredictability is a constant. Risk management is not just a good practice; it is a necessity.

In spread betting, risk management revolves around employing specific techniques to protect your investments. Two key practices are setting stop-loss orders and managing position sizes. Stop-loss orders help limit potential losses by automatically closing a trade when a predefined price level is reached. Position sizing ensures that you allocate a reasonable portion of your capital to each trade, reducing exposure to any single trade's adverse effects.

CFD trading requires tailored risk management strategies. This includes adjusting leverage levels to suit your risk tolerance and avoiding overleveraging, which can magnify losses. Additionally, managing overnight positions is crucial as these can incur additional costs and market risks.

While specific risk management techniques may vary between spread betting and CFD trading, the fundamental principle remains constant: effective risk management is indispensable. Both methods demand vigilance, discipline, and a thorough understanding of the markets. Comparing and contrasting these approaches highlights their unique aspects, but the overarching goal remains consistent - preserving capital and minimizing losses to enhance your overall trading experience. Remember that no single strategy fits all, and adapting your risk management approach to your trading style and preferences is key to success.

Conclusion

In conclusion, it's essential to recognize that both spread betting and CFD trading offer unique advantages and disadvantages. While spread betting provides tax advantages and flexibility, CFD trading offers more extensive market access. However, these benefits come with their own set of risks and considerations.

As you contemplate your trading approach, remember that there is no one-size-fits-all solution. Your choice should align with your trading goals, risk tolerance, and financial situation. Forex trading can be rewarding, but it requires dedication, knowledge, and a well-thought-out strategy to succeed in the long run.